Content

If you were a legal resident of Massachusetts and your gross income in 2022 was more than $8,000, you are required to file a Massachusetts income tax return. In this situation, if you do not file you will not receive the refund. If you did not have any state tax withheld, and you made less than $8,000 in MA, then you don’t need to file.

- Incomes derived from wages, salaries, self-employment, and commissions are taxed at 5.15%, regardless of the amount.

- Condo owners are also entitled to a credit for repairs done to common areas in addition to the work done in their individual units.

- That means that your net pay will be $43,085 per year, or $3,590 per month.

- It added, “We also do not recommend amending a previously filed 2022 return.” Amended returns have been caught up in the IRS’ backlog, leading to processing delays.

- Form 1-ES Instructions – Estimated Income Tax InstructionsIf you are self employed or need to file Form 1-ES for other reasons, these instructions will help you to fill out and file the form correctly.

Complete and e-File these 2022 state forms in conjunction with your federal income tax return. As you go through eFile.com tax interview, the application will select the correct state forms for you. All these forms will then be e-filed by you to the state tax agency.

Massachusetts Gas Tax

If you believe you may have a tax filing obligation in another state, please refer to the state’s department of revenue or taxation website to determine your personal tax filing requirements. Massachusetts will require the payment of estimated taxes if you expect to owe more than $400 in taxes on income not subject to withholding. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due.

- The table below summarizes the estate tax rates for Massachusetts and neighboring states in 2016.

- Form 1 Instructions – Individual Income Tax InstructionsUse these instructions to help you fill out and file your Form 1 individual income tax return with the Massachusetts Department of Revenue.

- The most significant taxes in Massachusetts are the sales and income taxes, both of which consist of a flat rate paid by residents statewide.

- Rocky was a Senior Tax Editor for Kiplinger from October 2018 to January 2023.

- The link below is to the most recent stories in a Google news search for the terms Massachusetts taxes.

- Other exempt items include newspapers, admissions tickets (i.e. to movies or sporting events), professional or personal services and most health care products.

Massachusetts does not have a standard deduction, but it allows many of the same itemized deductions as the federal government, as well as some additional ones. If you are single you can claim a standard deduction of $12,400. So, if you pay more than $12,400 in state income taxes and other itemized deductions, then consideritemizing your taxes. You can save time and money by electronically filing your Massachusetts income tax directly with the .

Massachusetts State Income Tax Credits

As a 501 nonprofit, we depend on the generosity of individuals like you. Help us continue our work by making a tax-deductible gift today. Please remove any contact information or personal data from your feedback.

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. You can pay your Massachusetts state taxes online at MassTaxConnect (through the state’s Department of Revenue) or via mail. This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees .

for Filing Extensions

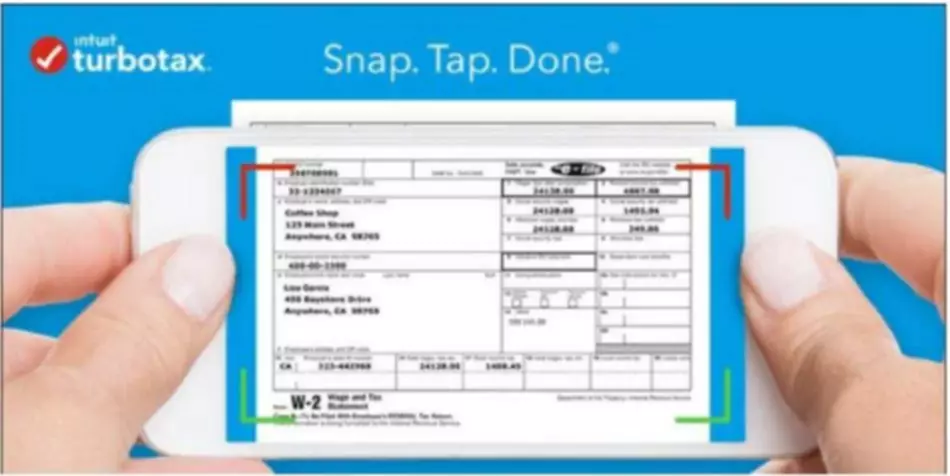

The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package. Form 1-ES – Estimated Individual Income Tax ReturnYou must file estimated income tax if you are self employed or do not pay sufficient tax withholding. Form 1-ES needs to be filed with the Massachusetts Department of Revenue on a quarterly basis. Please remember that the income tax code is very complicated, and while we can provide a good estimate of your Federal and Massachusetts income taxes, your actual tax liability may be different. The table below provides the mean amount of property taxes paid in 2012, as well as property tax as a mean percentage of home value for 2014, in Massachusetts and neighboring states.

State massachusetts state income tax taxes vary by state and are an amount of money that you pay to the state government based on a percentage of your income. Learn more about income taxes and other common tax facts in the state of Massachusetts here. Most food sold in grocery stores is exempt from sales tax entirely. Clothing purchases, including shoes, jackets and even costumes, are exempt up to $175. A product that costs more than $175 is taxable above that amount, so a $200 pair of shoes would be taxed at 6.25% on the $25 above the exemption limit. Other exempt items include newspapers, admissions tickets (i.e. to movies or sporting events), professional or personal services and most health care products.

Additional Resources

You must report such income by filing a Massachusetts Nonresident/Part-Year Resident Income Tax Return, Form 1-NR/PY. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.